The end goal of any e-commerce website is always ultimately to sell. That's why it's just hugely important that your customers can make payment in a safe and trusted payment environment. There are a lot of things that need to be in place to have a converting webshop, but a secure way to pay is essential.

E-commerce companies have several options available to them when it comes to online payments. Would you like to know how best to choose an online payment system? What online payment methods are available? Then be sure to read on!

1. What are Payment Service Providers?

You have a webshop and are looking for a good way to offer payments. But how exactly does a payment process work? We won't go into too much detail here, but will explain the basics. Basically, sales and payments on a web shop are as simple as in a store; your customer makes a purchase and a money transaction goes from his or her bank to your bank account. The difference is that in the store you use a payment terminal or cash and with a webshop this is obviously not possible. Web shops use a Payment Service Provider or a PSP. As owner of a webshop, a reliable PSP is one of the first things you should look for when you want to work out a payment module. A PSP has agreements with several banks, so they can check, for example, whether there are sufficient funds in your customer's account.

How do you choose the Payment Service Provider for your webshop?

- Look at the costs! Some providers charge a startup fee; other PSPs include it in their subscription cost. Also, you may be able to pay per purchase. This can be done in two ways: you can pay a flat fee per transaction or a percentage of the purchase amount.

- Collecting versus distributing: The difference is simple! A collecting PSP collects the money from your customers and afterwards transfers it to your account. A distributing provider does not receive the money itself, but plays intermediary. Which means you will also have to enter into a contract with a bank.

- What is the payout period of the PSP? This can vary greatly: daily, weekly or monthly.

- Modules and plug-ins? Some payment providers have modules and plug-ins that make integration into your shop easier. For example, there are PSPs that offer a Magento module.

Some examples of Payment Service Providers are Mollie, Ingenico, MultiSafePay and Adyen. Not only do they make payment intuitive for the customer and easy for the shop owner. They also have the great advantage that they are often recognizable to consumers. Because they are recognizable, chances are your customer will have already had a good experience with them. In that respect, it feels familiar to your customer and they will be more likely to make a purchase. The chance of an abandoned cart is thus reduced.

2. What are payment methods for e-commerce?

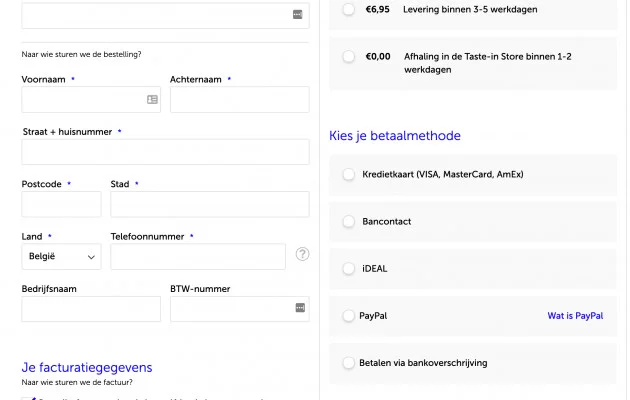

There is a difference between a payment provider and the various payment methods. Payment means or payment methods is one way to make your payment. Think of Bancontact, credit card, etc.

The most commonly used payment methods in Belgium are:

- Bancontact: Allows Belgian consumers to pay through their own bank. Recently, consumers can easily make payments through the Bancontact app on their phones using a QR code.

- Credit card: Credit cards, such as Visa and Mastercard, allow people around the world to make purchases.

- After payment: This method is on the rise. Companies such as Klarna and Afterpay offer consumers the option of paying afterwards. This lowers the threshold to make a purchase and increases the conversion of your webshop.

- iDEAL: Used mainly in the Netherlands, iDEAL allows your customers to pay in the familiar payment environment of their own bank. If you are a Belgian webshop and want to sell in the Netherlands, you need iDEAL.

- PayPal: Through an account on PayPal, consumers can checkout on your webshop. They can upload money to this account and pay with their “virtual wallet”.

- Wire transfer: This method is chosen less and less, because it requires more steps. However, it is still often chosen by an older target group.

- Direct Banking: Many banks offer the ability to checkout in their online banking. Your consumer is redirected to the bank's app or website and makes the payment there in a familiar environment. Examples include KBC/CBC, Belfius and ING Homepay.

There are a few others you may be familiar with, such as Maestro, Direct Debit, Sofort (mainly used in Germany), installment payments and gift cards.

3. Tips for choosing payment methods for your shop

You now know which ones there are, but would also like to know which payment methods to offer yourself? We will already give you the most important tip: definitely choose more than one! As an online store, you should offer several options to your consumer, so you have more chance that he will complete his purchase. It is possible to choose one payment method and offer it. But consumers are creatures of habit and often have one favorite way to pay. Several Payment Service Providers therefore offer multiple payment methods to integrate on your webshop.

We give you some tips to choose the right payment methods for your webshop.

- Look at your target audience. Much depends on your target audience for your e-commerce activity. What payment methods do they use? Are they early adopters and good with new technologies or do you have an older target audience? Also important to look at which devices your most purchases happen on. Some payment methods are better suited to mobile payments than others.

- There are local differences. We talked earlier about how iDEAL is used more in the Netherlands, Sofort in Germany and Bancontact in Belgium. Depending on where you generate the most sales, you will need to provide other payment methods on your website. For example, under Dutch law, post-payment is mandatory. So if you sell a lot on the Dutch market, it's also a good idea as a Belgian webshop to think about offering this.

- What are the integration options? Especially when looking for a good payment platform that offers various payment methods, it is important to start looking at how well it will run on your webshop. For example, is integration with Magento available?

- Determine your priorities! What is most important for your webshop? Which functionalities should definitely be present in your PSP? Do you want to offer one-page check-out, fast check-out to your customers?

There are many options and possibilities to tailor the payment process to your webshop. Keep in mind that you want to maintain your customer's trust during the entire payment process, from adding products to the shopping cart to the shipping confirmation. You can only achieve this by creating an environment that feels familiar and recognizable.

Want to know more about payment options for web shops?

Need help integrating your payment methods? Feel free to contact one of our experts without obligation!